Dr. Yi Qian, MRSI Systems: Automated Die Bonding Trends in the 5G Era

The arrival of 5G marks a new era for the manufacturing supply chain. This transformation presents new challenges for die bonding and packaging processes. As a leader in the automated packaging industry for global optoelectronics, MRSI Systems has launched new products and technologies to tackle these challenges. During the 20th annual China International Optoelectronic Exposition (CIOE) held at Shenzhen Convention and Exhibition Center in September of 2018, Vice President of Product Management Dr. Yi Qian introduced the full range of MRSI’s “One Stop Shop” products to fiber.ofweek.com. Dr. Qian discussed some of the leading trends which are affecting this dynamic industry.

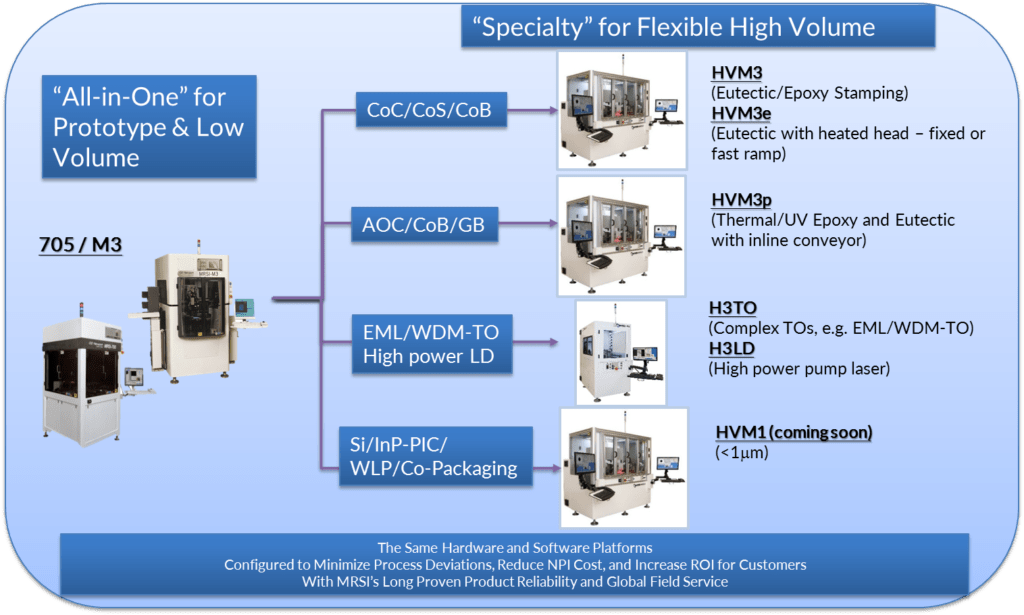

During the 2018 CIOE, MRSI introduced the newest models based on the popular MRSI-HVM3 high-speed platform in order to achieve a “One Stop Shop” solution. Based on the previous success of chip on carrier (CoC) assembly, the latest configurations extend to other key packaging processes including CoB/AOC/PCB and gold-box packaging. These products enable multi-purpose, high-speed bonding and packaging that are carried out on just one machine. On top of that, MRSI has introduced two other high-speed die bonding equipment. These machines are able to package high-power semiconductor lasers for industrial lasers applications, and multi-die WDM & EML-TO products to support the upcoming 5G wireless rollout.

MRSI ’s “One Stop Shop” Solutions

Dr. Qian said, “MRSI’s products have the advantage of the highest speed in the industry while maintaining the best accuracy and flexibility. Currently, the optoelectronic applications for such products are multi-chip, multi-functional, and previously required multiple fixed purpose equipment to complete, which is inefficient. To meet market requirements, the equipment must have the ability to complete more processes and do so on a single system. MRSI’s products do this by using multi-chip, multi-process flow while maintaining the highest speed for maximum efficiency.”

Technology Investment

Since 1984, MRSI has been investing in R&D and serving optoelectronic and microelectronic customers. Dr. Qian states, “MRSI has been moving in the direction of high-precision and high-speed for 34 years. We were the leading supplier for R&D and volume manufacturing for the last telecom boom during dot-com time back in the year 2000. Since then, our R&D is focused on improving accuracy to rise above market demands. In recent years, the increasing popularity of data centers brings a high demand for much higher volumes for our customers, which means the speed of all manufacturing equipment must increase.”

MRSI’s History of Innovation

According to Dr. Yi Qian, there are three core competencies to support MRSI’s long-lasting leadership in the market. First of all, the R&D team of highly qualified professionals has been working with the company for a range of 10 to 20 years. The making of a die bonder is different from general component equipment. Continuity for the R&D team is imperative for both hardware and software development. With stable core talent and unwavering focus, the company can provide the highest quality products for customers. Overall, the R&D team is a key component in MRSI’s continuous growth.

Secondly, MRSI’s high-speed die bonding machine platform is the perfect combination of speed, precision, flexibility, and reliability. Most manufacturers in the industry believe that special semiconductor equipment for specific use cannot operate with speed, precision, and flexibility at the same time. Through continuous innovation and bold exploration, MRSI’s new 3-micron high-speed platform (MRSI-HVM3) has demonstrated comparable speed to the industry’s fastest 7-micron dedicated machine. This machine also maintains MRSI’s traditional advantages in flexibility and reliability. These are critical and required for the production of optoelectronic devices that combine high-volume and high-mix characteristics.

The Ultra-Fast MRSI-HVM3

Lastly, MRSI’s bonding head design is unique from other companies. During the bonding process there is an up and down movement similar to a hammerhead. If the “hammerhead” is too heavy due to the design, the drop down will create a strong force. Conventional electronic devices may be built to withstand this smashing force, however optical chip devices or ultra-thin electronic chip devices are much more fragile. The inevitable internal damage will affect the lifetime of the device, and thus affect the yield.

MRSI’s bonding head features a light-weight design which is capable of controlling the force of the bonding head, supported by a real-time close-loop control circuit, when making contact with the surface of the chip. This technology requires the integration of die bonding hardware, control software, optics and mechanical technology all of which are just a few of MRSI’s greatest advantages in the field of optoelectronic devices and ultra-thin electric chips.

MRSI Joins MYCRONIC

In addition to its own R&D team building, MRSI has also improved its strength through other means. In June of 2018, MRSI was acquired by MYCRONIC – a world leader in production equipment for electronics and display manufacturing in Sweden. Dr. Qian believes the merger is mutually beneficial for both MYCRONIC and MRSI and comes with two significant advantages. One advantage is MYCRONIC being a global company will enhance MRSI in the global market and sales channels. Some of MYCRONIC subsidiaries’ products are complementary to MRSI’s products. There are applications in which products from each company are applied at different steps of the same production line. Another advantage is the two companies can work together to develop new products and new applications in order to meet the needs of a broadened customer base in a much larger market space. Overall, it is a complementary relationship in the world of technology and business development.

Steady Growth Through Transformation and Innovation

MRSI sets a high standard of performance and maintains profound growth, now and in recent years. Dr. Qian explains two notable reasons for this growth. MRSI has successfully expanded from the traditional telecommunications industry into the data center field. The company has also expanded into a growing number of emerging optoelectronics applications, such as silicon photonics, LiDAR, special laser light for cars, VR/AR devices and modules, industrial high-power semiconductor lasers, etc.

The Chinese market is critical to MRSI. Dr. Yi Qian explains, “High-tech manufacturing is centered in China. Over the years, MRSI has developed a large customer base with extensive equipment installation in China. China is now planning to promote chips and other high-tech fields in its manufacturing, which require a great deal of automated production equipment. MRSI products are capable of world leading high-precision, high-speed, and high-flexibility, and therefore have a positive influence on the Chinese market. MRSI’s involvement in serving the Chinese market for many years makes for a trusting and reliable partner in China’s vastly growing industry.”

When it comes to the China market, Dr. Qian mentioned that in the first half of this year (2018), ZTE’s business was affected due to some regulatory reasons. The affected businesses were mainly in the telecommunications industry, and the data center market had not been affected. The largest market of MRSI’s business right now is the data center. MRSI has a good position in the market and the business maintains steady growth.

MRSI and its partner CYCAD Century Science and Technology in CIOE

Business Opportunities in China

Dr. Yi Qian believes that opportunities lie both at home and abroad. Some global companies including those in the US, with their current production bases in China, may consider moving some of the manufacturing out of China due to global trade uncertainty. Some have already taken action to move to Southeast Asia or other regions. It has been proven this has little to no impact on MRSI’s business, since no matter where the production moves, they still need equipment.

If we look at the China market from a different perspective, we can see that China plans to develop its own chip industry. There are already many companies entering the chip and device packaging industry. As the chip industry progresses, Dr. Qian predicts China’s entire optoelectronics industry will usher substantial development. As the overall growth increases, so will the demand for more equipment. Even though the industry as a whole may have some adjustments in the global production base in the next few years, for MRSI, China’s market share not only is less likely to be reduced but has more potential to grow. The upcoming 5G era will drive the Chinese market to grow even further.

———————————

The original Chinese interview was published in September 2018 by OFWeek.